springfield mo city sales tax rate

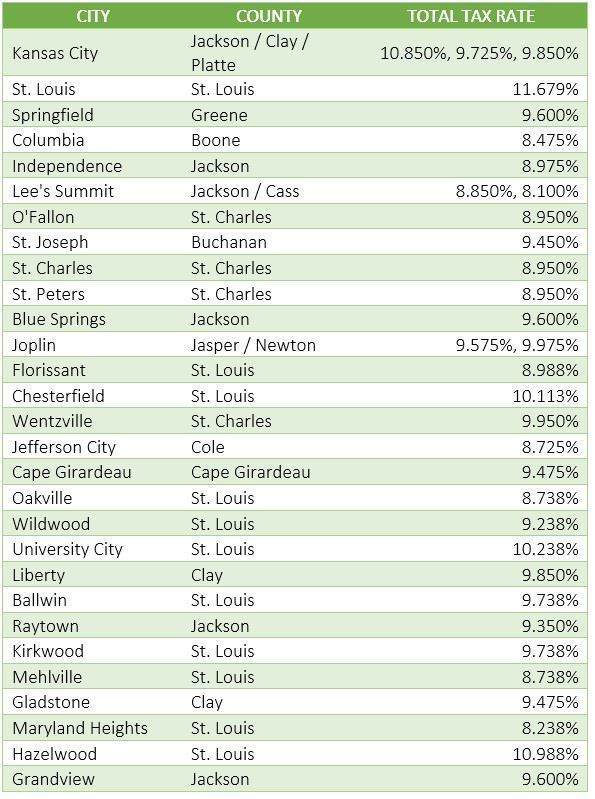

SalesUse Tax Rate Tables. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Average Sales Tax With Local.

. The base sales tax rate is 81. The average cumulative sales tax rate in Springfield Missouri is 782. Citizens Tax Oversight Committee.

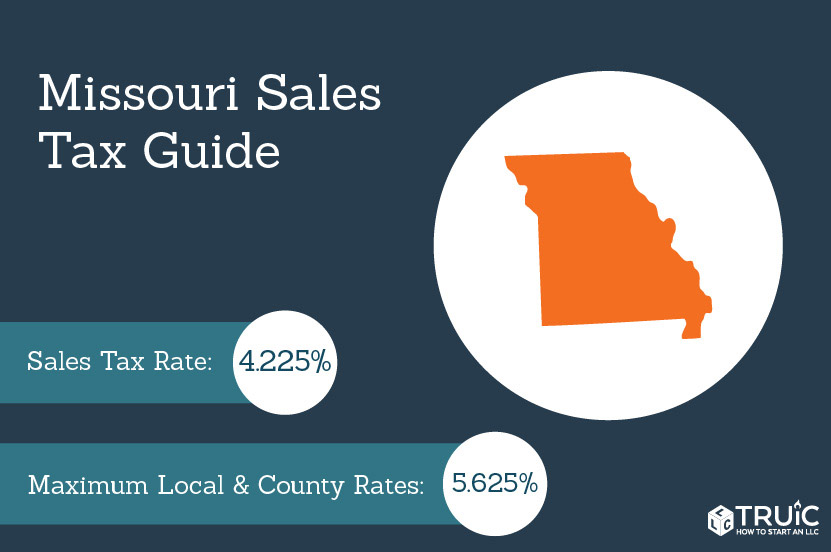

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. Did South Dakota v. 1028 rows 2022 List of Missouri Local Sales Tax Rates.

There are a total of 741 local tax jurisdictions across. City of Springfield Busch Municipal Building 840 Boonville Avenue Springfield MO 65802 Phone. Kansas City Dwntwn St Cid.

The Missouri sales tax rate is currently. Start a Development Project. Springfield is located within Greene County Missouri.

The County sales tax rate is. Higher sales tax than 62 of Missouri localities 15 lower than the maximum sales tax in MO The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Police Fire or EMS dispatch.

2022 Missouri Sales Tax Changes Over the past year there have been 98 local sales tax rate changes in Missouri. Indicates required field. This includes the rates on the state county city and special levels.

Missouri MO Sales Tax Rates by City The state sales tax rate in Missouri is 4225. The tax continues to be 27 cents for 100 of assessed value. What is the sales tax rate in Springfield Missouri.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Missouri has recent rate changes Wed Jul 01 2020. You can print a 81 sales tax table here.

What is the sales tax rate in the City of Springfield. With local taxes the total sales tax rate is between 4225 and 10350. Tax Rates By City in Greene County Missouri.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. 417-864-1000 Email Us Emergency Numbers. Wayfair Inc affect Missouri.

Select a year for the tax rates you need. Within Springfield there are around 15 zip codes with the most populous zip code being 65807. This page will be updated monthly as new sales tax rates are released.

For each and every month thereafter an additional two percent 2 of the license tax will be added until the tax is fully paid. Select the Missouri city from the list of popular cities below to see its current sales tax rate. If you need access to a database of all Missouri local sales tax rates visit the sales tax data page.

Payments sent through the mail must be postmarked on or before the twentieth 20th of the month in order to avoid incurring penalty charges. The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield. The minimum combined 2022 sales tax rate for Springfield Missouri is.

The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax. Notify Me Watch Live Meetings. Missouri has a 4225 sales tax and Greene County collects an additional 175 so the minimum sales tax rate in Greene County is 5975 not including any city or special district.

The Springfield sales tax rate is. There is no applicable special tax. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax.

Find Sales and Use Tax Rates. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. 17 rows Springfield compares or benchmarks itself to other cities in our size and region.

The total penalty will not exceed thirty percent 30 of the tax. This is the total of state county and city sales tax rates. Enter your street address and city or zip code to view the sales and use tax rate information for your address.

Click any locality for a full breakdown of local property taxes or visit our Missouri sales tax calculator to lookup local rates by zip code.

Setting Up Sales Tax In Quickbooks Online

Setting Up Sales Tax In Quickbooks Online

Highest Gas Tax In The U S By State 2022 Statista

Sales Tax On Grocery Items Taxjar

Missouri Car Sales Tax Calculator

The 2001 And 2003 Tax Relief The Benefit Of Lower Tax Rates Tax Foundation

Taxes Springfield Regional Economic Partnership

Nebraska Sales Tax Rates By City County 2022

Missouri Sales Tax Rates By City County 2022

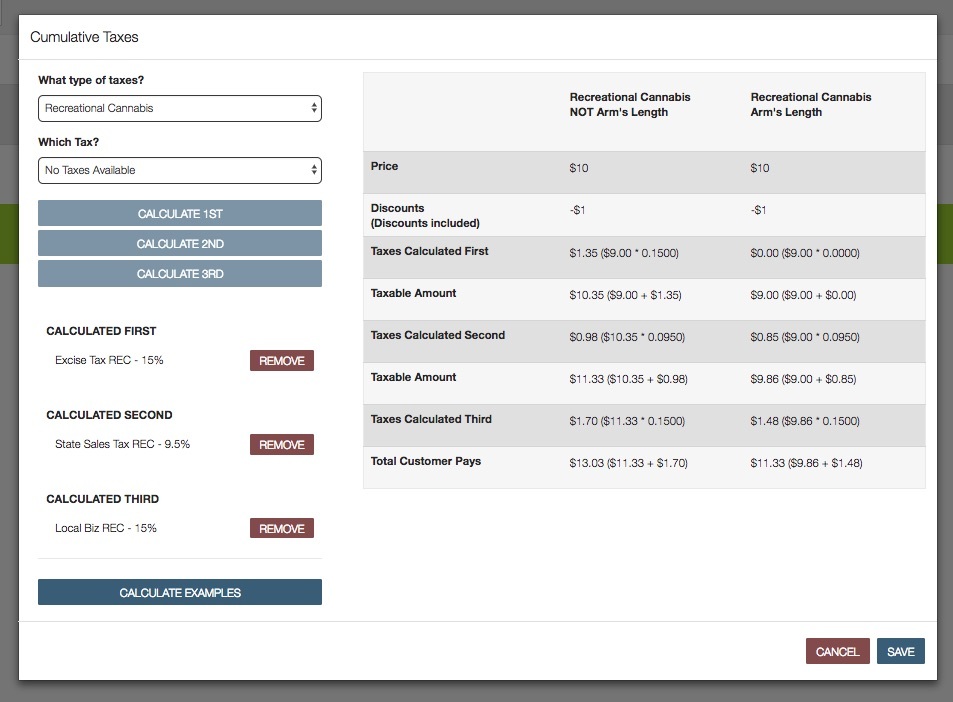

How To Calculate Cannabis Taxes At Your Dispensary

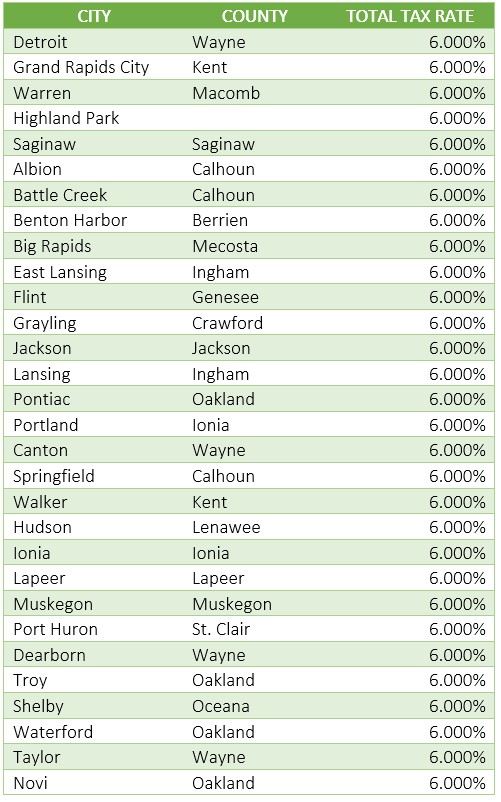

Michigan Sales Tax Guide For Businesses

Missouri Income Tax Rate And Brackets H R Block

States Are Imposing A Netflix And Spotify Tax To Raise Money

Missouri Sales Tax Guide For Businesses